Take Your Credit to the Next Level

Take Your Credit to the Next Level

Boosting your credit score can help you qualify for lower interest rates and better loan opportunities.

How Our Credit Repair Process Works

Get Started Today with a FREE score & Credit Report Summary

or you can SIGN UP NOW for Credit Repair

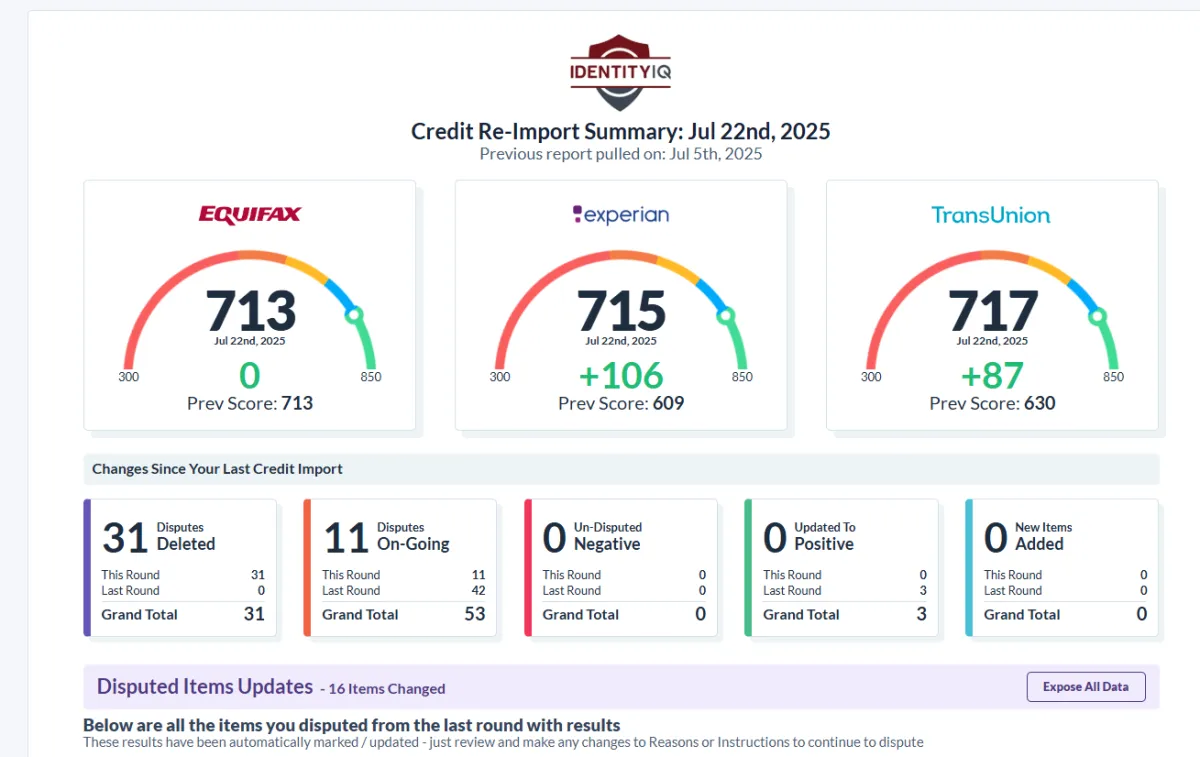

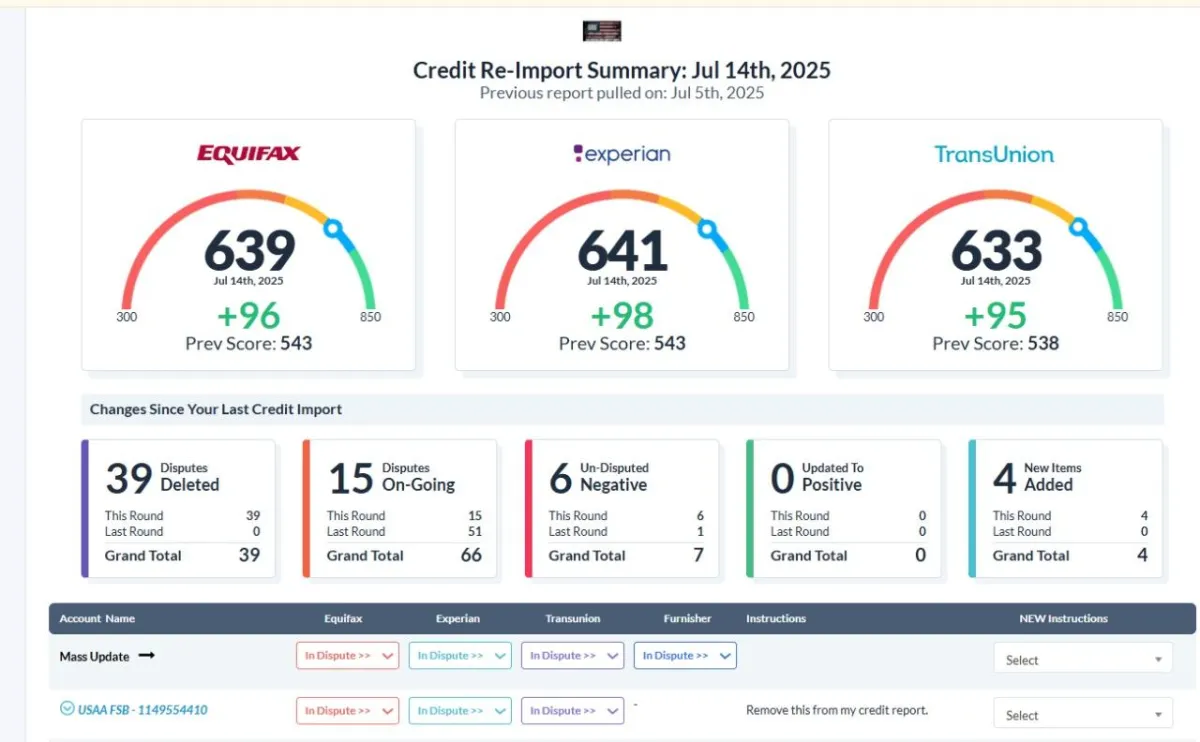

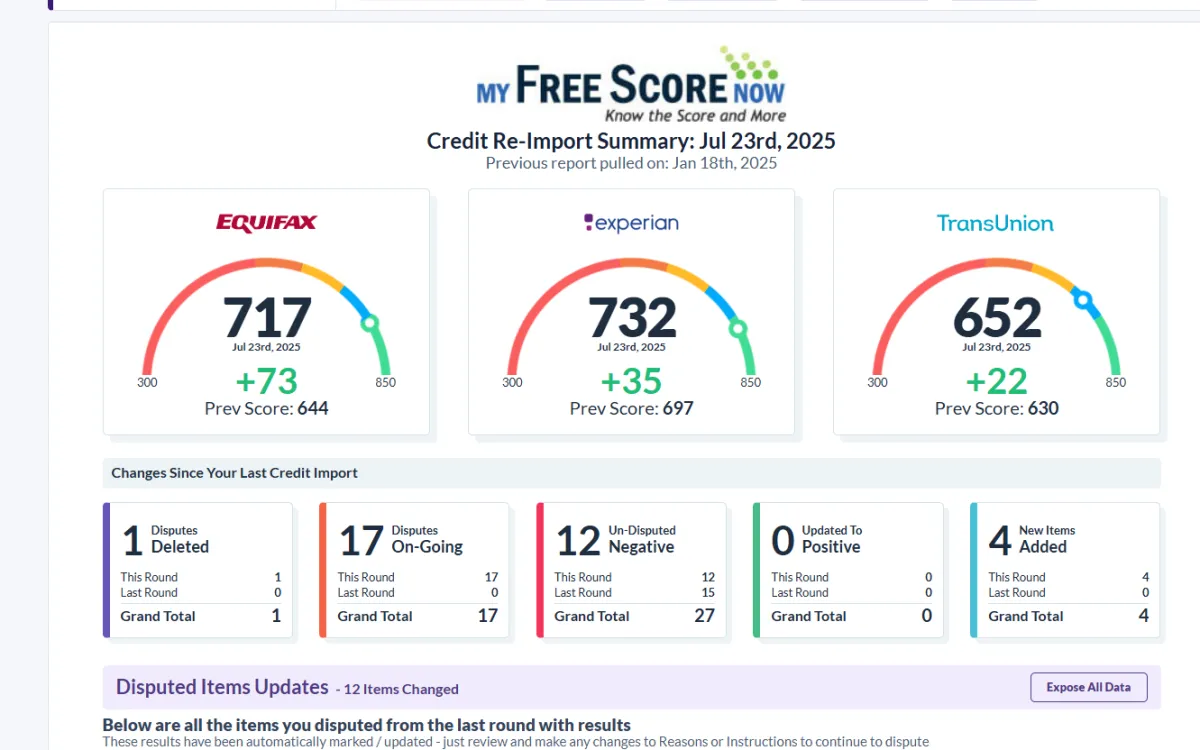

Latest Results From Our Clients

Latest Results From Our Previous Clients

Why Your Credit Matters?

1. EASIER APPROVAL FOR CREDIT

A solid credit history builds lender confidence in your ability to repay. This makes it easier to get approved for credit cards, mortgages, personal loans, and auto financing—opening up more financial opportunities.

2. LOWER INTEREST RATES

Even slight reductions in interest rates can save you thousands over time on major loans like mortgages or student loans. Good credit helps you qualify for these lower rates, as lenders view you as a lower-risk borrower.

3. MORE FAVORABLE LOAN TERMS

Strong credit can lead to higher loan amounts, longer repayment periods, and reduced fees. You may also benefit from more flexible repayment options, such as deferred payments during tough times.

Keeping a strong credit score is key to maintaining financial stability and unlocking future opportunities.

Keeping a strong credit score is key to maintaining financial stability and unlocking future opportunities.

Frequently Asked Questions

How long does credit repair take?

It depends on your report, but many clients start seeing results in 30-90 days

Do you guarantee score increases?

We guarantee effort and transparency—but since credit bureaus control the final decision, no company can promise specific scores.

Is credit repair legal?

Absolutely. The Fair Credit Reporting Act (FCRA) gives you the right to dispute inaccurate info

Have Further Questions?

Please Leave us a Message

© Copyright 2025. Next Level Credit Repair. All Rights Reserved.